𝐖𝐡𝐲 𝐃𝐨 𝐒𝐚𝐥𝐚𝐫𝐢𝐞𝐝 𝐈𝐧𝐝𝐢𝐯𝐢𝐝𝐮𝐚𝐥𝐬 𝐑𝐞𝐜𝐞𝐢𝐯𝐞 𝐈𝐧𝐜𝐨𝐦𝐞 𝐓𝐚𝐱 𝐍𝐨𝐭𝐢𝐜𝐞𝐬?

- Sep 27, 2025

- 2 min read

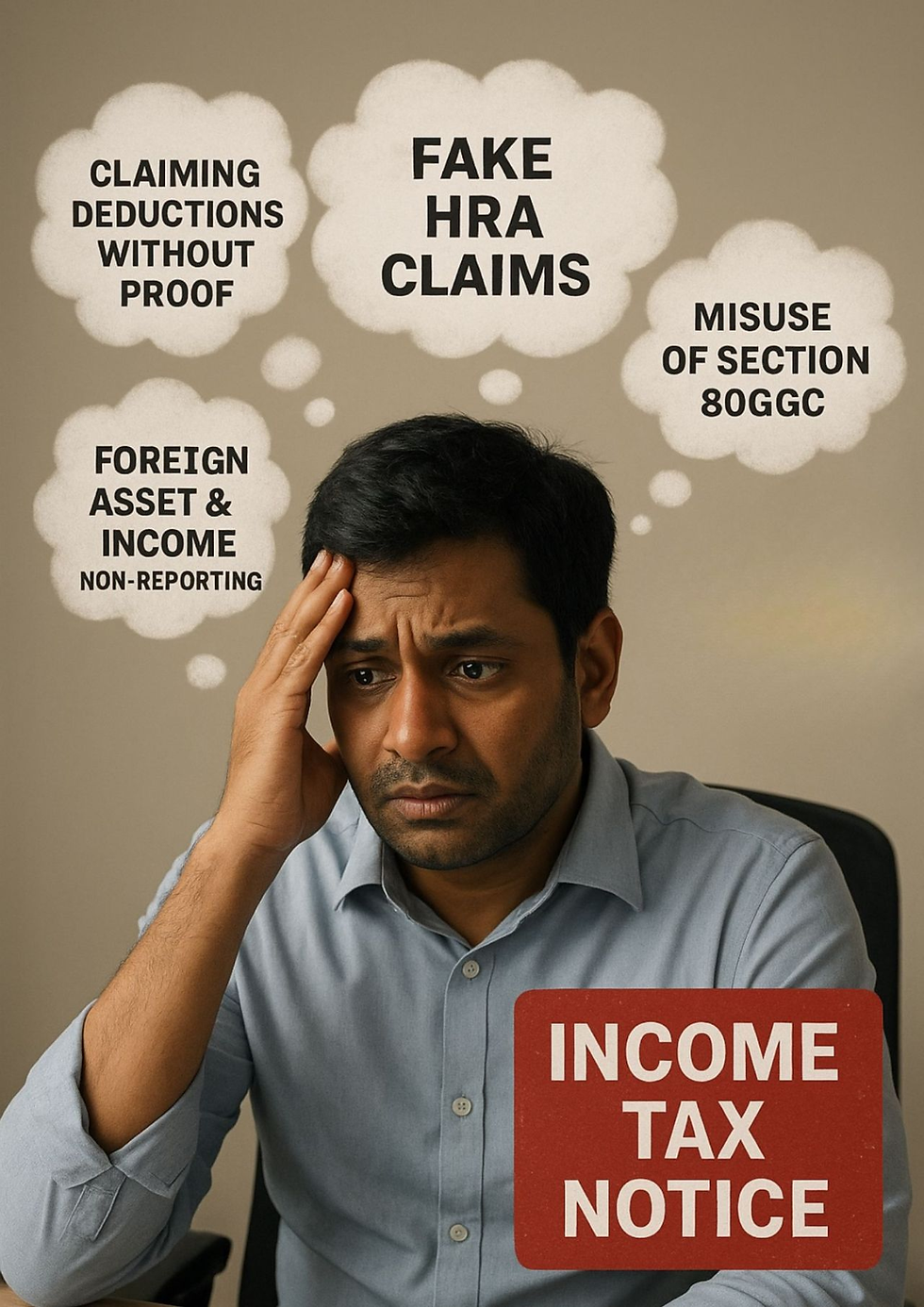

𝘏𝘙𝘈, 80𝘎𝘎𝘊, 𝘍𝘢𝘬𝘦 𝘋𝘦𝘥𝘶𝘤𝘵𝘪𝘰𝘯𝘴 & 𝘍𝘰𝘳𝘦𝘪𝘨𝘯 𝘈𝘴𝘴𝘦𝘵𝘴 – 𝘛𝘩𝘦 𝘉𝘪𝘨𝘨𝘦𝘴𝘵 𝘵𝘳𝘪𝘨𝘨𝘦𝘳 𝘱𝘰𝘪𝘯𝘵𝘴

1. Fake HRA Claims

House Rent Allowance (HRA) is one of the most commonly claimed exemptions. But it’s also one of the most misused.

People submit inflated rent receipts without actually paying rent.

Some show rent paid to parents or relatives but fail to have a valid rent agreement and bank transfer proof.

If annual rent exceeds ₹1,00,000 and landlord’s PAN is missing, it becomes an easy trigger for scrutiny.

👉 Remember: The department cross-checks landlord details, PAN, and even bank statements. Claim HRA only if you have proper evidence.

2. Misuse of Section 80GGC (Political Donations)

Donations to political parties under Section 80GGC are fully deductible. Sounds tempting, right?

But here’s the catch: this section is under direct monitoring.

Many taxpayers falsely show political donations to reduce taxes.

In reality, the department verifies these directly with political parties and the Election Commission.

👉 Fake claims = 100% disallowance + penalty + interest.

3. Claiming Deductions Without Proof (80C, 80D, etc.)

This is another common mistake. People try to reduce taxes by claiming deductions they never invested in.

Fake LIC premiums, PPF deposits, or ELSS investments under Section 80C.

Non-existent medical insurance under Section 80D.

Fabricated tuition fee or loan interest receipts.

👉 With digital payments, it’s easy for the department to verify. No proof = disallowance + fine.

4. Non-Reporting of Foreign Assets & Income

This is the biggest mistake that salaried professionals and NRIs returning to India make.

Not reporting RSUs, ESPPs, stock options, overseas bank accounts, or rental income abroad.

Believing that “if income is not brought to India, it’s not taxable” – which is completely wrong.

For Indian residents, global income is taxable, and foreign assets must be reported in the FA schedule of ITR.

With CRS (Common Reporting Standard) and FATCA agreements, foreign banks share your data with Indian authorities.

👉 Non-disclosure can lead to hefty penalties, FEMA violations, and even prosecution.

Tax planning is smart. Fake claims are not.

If you want to save tax legally:

✔️ Claim only genuine deductions

✔️ Keep documentary evidence ready

✔️ Disclose all income and assets truthfully

A little caution today can save you from a big income tax notice tomorrow.

Comments